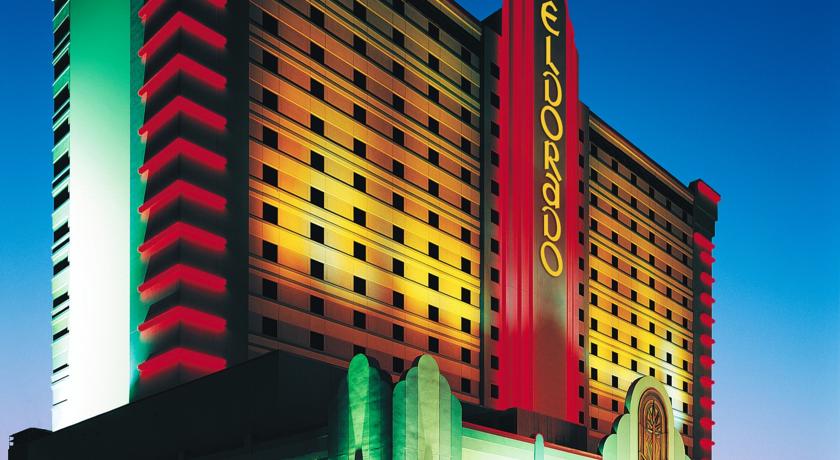

New Jersey gambling regulators began Wednesday to consider Nevada-based Eldorado Resorts Inc.’s plan to buy Caesars Entertainment Corp. in a sweeping $17.3 billion deal affecting four of nine casino properties in Atlantic City.

Desktop version of El Dorado Palace casino is a standalone program for Microsoft Windows which allows you to play your favourite casino games without even visiting the respective site. El Dorado Palace provides high-quality online gambling that features the best.

Approval by the New Jersey Casino Control Commission could come Thursday, and would be the final hurdle in Eldorado’s bid to become what Commissioner Alisa Cooper called “the biggest gaming company in the world” — a casino giant controlling 52 properties in 16 U.S. states under the Caesars Entertainment brand.

“Atlantic City is going to be a significant piece of this combined company,” Eldorado chief executive Thomas Reeg testified at a daylong video hearing streamed on the internet.

Company executives acknowledged previous understaffing at Atlantic City properties and promised that future job cuts at the combined company’s properties would be cleared first by state regulators.

A $25 million sale of Bally’s Atlantic City hotel-casino by Caesars Entertainment and VICI Properties to Rhode Island-based Twin River Worldwide Holdings is pending. That would leave Eldorado with three resorts within driving distance of New York and Philadelphia: Caesars, Harrah’s and the Tropicana Atlantic City.

The company is committing to keeping the properties open for at least five years. Eldorado Chief Financial Officer Bret Yunker promised $400 million in improvements to the three properties over the next three years, followed by reinvestment of 5% of revenues annually.

“Atlantic City, where it sits, is in the middle of a gigantic population center,” Reeg said. “It’s our job to make our properties attractive enough for people to get in the car or get in that charter plane.”

Nevada casino regulators approved the buyout last week, affecting properties that include Caesars Palace, Paris Las Vegas, Planet Hollywood, Flamingo and Linq on the Las Vegas Strip.

Indiana casino regulators approved the deal on Friday with a requirement that the merged company sell three of its five casinos there. There are 13 state-licensed casinos in the state, and one tribal casino. The Indiana Horse Racing Commission gave approval Monday.

The Federal Trade Commission accepted the plan June 26, after Eldorado agreed to sell properties in Kansas City, Missouri; South Lake Tahoe, California; and Shreveport, Louisiana.

Finalizing the cash-and-stock purchase plan took more than a year and was delayed by casino closures nationwide due to the coronavirus pandemic, Reeg and other company executives said.

Reno-based Eldorado would retain 56% of the merged company. It would continue operations and stock trades under the name Caesars Entertainment Inc. Executives and regulators on Wednesday repeatedly referred to it as “new Caesars.”

Billionaire American investor Carl Icahn would own more than 10% of the combined company and would be the largest single shareholder, Reeg said. Icahn acquired a large number of Caesars shares after the company emerged from bankruptcy protection in late 2017, and pushed for the sale.

____

This story has been corrected to say the number of company casinos in Indiana is five, and the number of state-licensed casinos is 13. There is also one tribal casino.

____

Ritter reported from Las Vegas.

© Photographer: Joe Buglewicz/Bloomberg A pedestrian walks in front of Caesars Entertainment Corp.'s Caesars Palace hotel in Las Vegas on June 4.(Bloomberg) -- Eldorado Resorts Inc. completed its $17 billion acquisition of Caesars Entertainment Corp., navigating a series of hurdles, including the global pandemic, to create a new powerhouse in the casino industry.

The merger, first announced in June of last year, capped a flurry of dealmaking for the once-small casino company. But the transaction faced obstacles, including several states where the new company’s market share exceeded the wishes of regulators, and the coronavirus, which shuttered casinos in the U.S. for nearly three months this year.

Eldorado, led by Chief Executive Officer Tom Reeg, had to scramble to find buyers for the some of the company’s properties. He raised as much as $772 million in a new stock offering, negotiated new loan terms with banks, and sold $6.2 billion in junk bonds to get the deal done. On July 10, regulators in Indiana approved the merger on the condition that the company sell three of its five properties in the state. New Jersey gave the green light last week.

The new company, which will use the Caesars name, is now the largest operator of casinos in the U.S., with some 55 properties. Reeg, a former bond-fund analyst and manager, is known for wringing profits out of even modest properties. The new company is expected to focus on the fast-growing business of sports betting, while cutting back on the customer incentives that have historically eaten into casino profits.

Eldorado Casino Locations

Bye to Buffets

Reeg said in a July 8 Nevada hearing that properties outside of Las Vegas would likely never offer buffets again. They cost the company $3 million each, per year, and were often given away to lure gamblers.

List Of Eldorado Casinos

Eldorado Online Casino Slots

Video: ElDorado Resorts CEO on merger approval with Caesars (CNBC)

“If you didn’t give me the free food, I’d show up anyway,” he said of his customers.

One major challenge: While the smaller markets where Eldorado has traditionally done business have bounced back quicker since reopening, the major tourist destination of Las Vegas has been slower to recover. Reeg told Nevada regulators he expects a rebound there in the fourth quarter.

Shares of Eldorado fell 2.2% to $37.16 in New York. Prior to Monday, the stock had declined 36% this year.

Play Eldorado Casino

Under its previous owners, Caesars struggled with its finances. A $30 billion leveraged buyout in 2008 left the company saddled with debt. Years of restructuring followed, as did the bankruptcy of its biggest division.

Investor Carl Icahn took control of Caesars last year and negotiated the sale to Eldorado. That company, based in Reno, Nevada, had just a few years ago been a small player, controlled by the founding Carano family. Now, their empire includes marquee properties such as Caesars Palace and Paris in Las Vegas, as well as Harrah’s in New Orleans.

Play For Fun Eldorado Casino

The new company will carry about $14 billion in total debt, however, at a time when consumer discretionary spending is uncertain.

For more articles like this, please visit us at bloomberg.com

©2020 Bloomberg L.P.